This week's issue of Bridging Bitcoin can be read in 7 mins and 14 seconds.

Have feedback on Bridging Bitcoin, or have any topic requests? Just hit “Reply” and send it our way to ken.chia@substack.com.

For those who are not yet subscribed, I write on Bitcoin and cryptocurrencies from a macro perspective. If that interests you, subscribe to get a weekly issue delivered directly to your inbox:

Top developments:

Bitcoin hits all time high above $28,000 in post-Christmas rally, resulting in a market cap of over $500 billion, exceeding that of Samsung, Visa and J.P. Morgan. (CoinTelegraph)

ETH crosses $740, up almost +30% in the past week (CoinTelegraph). Some catalysts include the expectation that the growing institutional demand for Bitcoin will spillover into ETH, and the upcoming CME Ethereum futures listing in January 2021.

Ripple, issuer the fourth largest cryptocurrency (XRP) by market cap, is sued by the SEC over 7-year, $1.3B ‘Ongoing’ XRP sale (FT). XRP has since fallen by almost -70% to <$0.20.

Merry Christmas🎁🎄! Wherever you are, I hope that you have had a safe and wonderful Christmas with your friends and family. It has been a tough year for many of us, and one where we start to be truly grateful and appreciate what we have...

This will be the last issue of 2020 - a year that has been stellar for crypto, with foundational rails built and strengthened for exponential institutional and mainstream adoption in 2021 and beyond.

It is that time of the year where family and friends gather for 5-hour lunches – amazing spreads with copious amounts of sangria and alcoholic spirits.

Coincidentally, Christmas this year also marks Bitcoin hitting its new all time high, crossing $28k over the Christmas weekend.

Matt Hougan, CIO of Bitwise Asset Management, summarized the current landscape with the following:

"What's happening now - and it's happening faster than anyone could ever imagine - is that Bitcoin is moving from a fringe esoteric asset to the mainstream... If it's going mainstream, there is just so much money on the sidelines that is going to have to come in and establish a position that it leaves me very bullish for 2021."

The demand side is pretty easy to explain: the institutional flood gates have opened, leading to a massive FOMO chain reaction from other institutions and retail. It also makes it easier to rationalize the narrative when names such as J.P. Morgan and AmEx are doing exactly that.

On the other hand, the supply side is a little more intricate (especially to non-Bitcoiners). Skeptics remain skeptics not just because of Bitcoin's initial complexity, but also because there is truly nothing else like Bitcoin.

The Twelve Years of Bitcoin

The concept of a fully electronic currency, one that is truly not controlled by any single entity, is not new. Since the rise of cryptography in the late 1970s, people began to realize that the concept might be possible.

It was not until 2008, when the pseudonymous Satoshi Nakamoto published the Bitcoin whitepaper, and subsequently launched the Bitcoin network in early 2009. Three decades in the making, Satoshi ultimately produced a digitally-native money system without central control by any single entity.

How was this made possible?

The reason for Bitcoin's dominance and resilience twelve years after its invention and counting, lies in its design enforced by code - rather than typically centralizing ledger entries of all Bitcoin transactions in one place (server, entity, bank etc), the Bitcoin ledger is instead duplicated and managed by thousands of computers across the world, separately run by many thousands of individuals (miners) and organizations (mining pools).

Let's use a game of poker to illustrate.

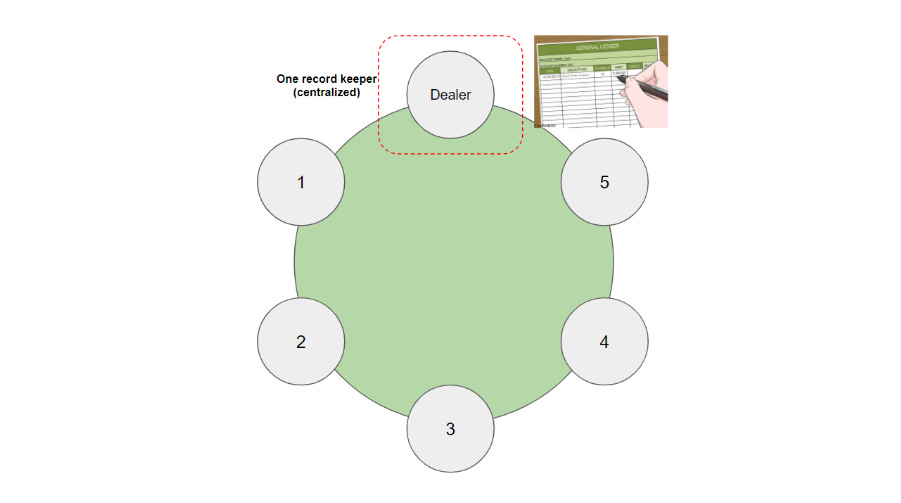

In a typical layout with one dealer at the table, assume that the dealer's sole job is to keep track of each player's chip stacks throughout the game (verify transactions):

In the second (hypothetical and cyberpunk-esque) example below, instead of one single dealer, we have a virtual audience of thousands of participants who assume the dealer's role in verifying transactions. Rather than maintaining one single ledger, in order for each new transaction to be added, every single one of the thousands aims to verify the true chip stack balances of the players. The first one in the audience to arrive at the truth (determined by cryptography), receives a specific amount of reward chips as compensation.

This (highly-simplified) example is analogous to Bitcoin mining - where the poker players, chip stacks and audience represent those transacting in Bitcoin, the transaction size and the Bitcoin miners respectively.

Mining Your Own Business

Using the poker reference above, Bitcoin miners are essentially getting paid for their work as auditors (or more accurately, competing to be the first successful one) - supporting the Bitcoin network, securing the accuracy of its distributed ledger and preventing double-spending. The Bitcoin network has been securely generating blocks, its transactions undisputed and uninterrupted ever since its inception in 2009.

Mining incentives are high. Even at its current halving cycle, successful Bitcoin miners receive 6.25 BTC in mining rewards (worth USD168,750 at time of writing) produced by the Bitcoin network. Superb.

More importantly, mining also produces more bitcoins into circulation, or "minting" currency. Currently, roughly 900 new bitcoins are mined into circulation per day (of which PayPal alone has already been buying more than 100% of).

True to its nature in rewarding those who are early, the Bitcoin protocol grants a higher amount of mining rewards to miners back in 2009 vs today, for example.

Half the Rewards, Double the Fun

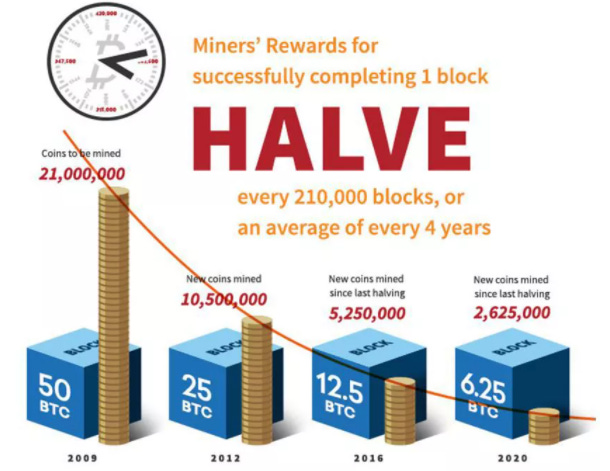

When Bitcoin was first mined in 2009, mining one block would earn you 50 BTC. Roughly every four years, this reward is halved - 25 BTC in 2012, 12.5 BTC in 2016, and now 6.25 BTC in 2020. This process is known as Bitcoin halving events.

Source: Investopedia

Halving events will continue to take place until the reward for miners reach zero, after the 33rd halving - estimated to occur in the year 2140. Eventually, it will then be impossible to create any new bitcoins.

This, however, does not mean that transactions then will cease to be verified. Miners will continue to verify transactions and will be paid in fees (by Bitcoin senders) in order to maintain the integrity of Bitcoin's network.

With a 21 million cap on the maximum amount of bitcoins to ever exist, 18.5 million already mined into circulation, plus the gradual reduction in the rate at which new bitcoins are mined into circulation, Bitcoin is a truly deflationary asset by design.

Keeping stock on Bitcoin

What does all of this mean for Bitcoin's value?

Since its future cash flows cannot be discounted (as it produces none), Bitcoin is often valued as a commodity instead - it does exhibit many of the same properties as gold, for example (durability, scarcity, portability, fungibility, etc).

Although Bitcoin's valuation is a frequently debated topic, most can agree that the factors influencing Bitcoin's price fall into either one, or both of the following:

The supply of bitcoin and its market demand; and/or

The cost of producing a bitcoin through the mining process (electricity, warehousing costs of computing equipment, cooling, etc)

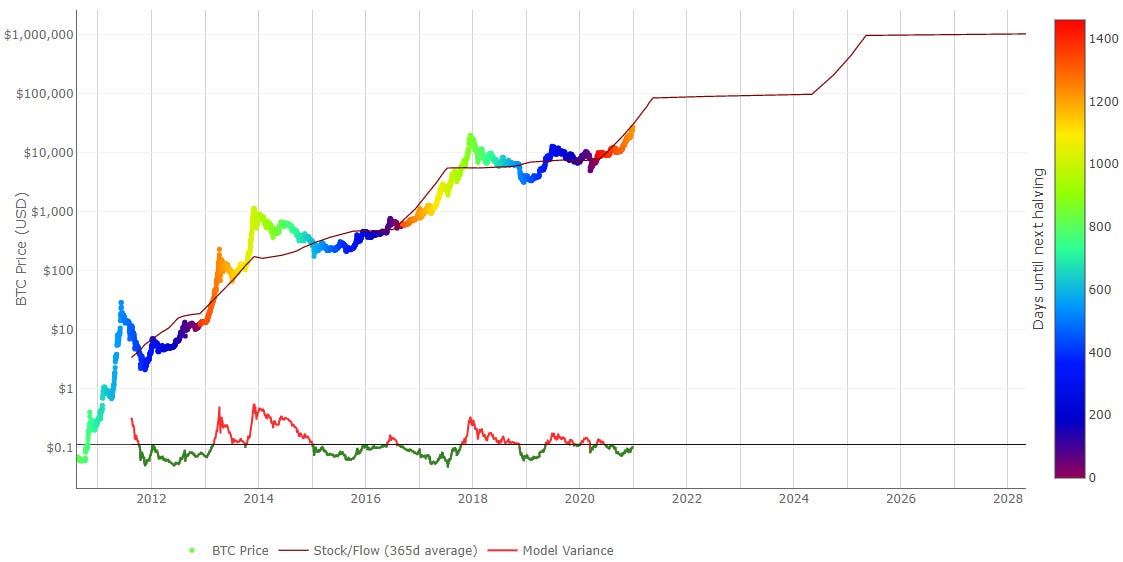

The stock-to-flow (S2F), which focuses on the supply side, is one of the more popular models in valuing commodities and Bitcoin. The S2F tells us how many years are required, at the current production rate, in order to produce the amount in the current stock. The higher the figure, the greater the scarcity.

Gold's S2F

Source: Seeking Alpha

Although gold's S2F has been on a consistent decline since 2008 (indicating that gold is becoming more abundant and less scarce) does that immediately indicate that you should be bearish on gold prices? Conversely, financial analysts are becoming increasingly bullish on gold, on the basis of massive stimulus printing globally, a weaker dollar, rising inflation expectations, etc.

Scarcity versus abundance is only one factor that determines gold's price.

Furthermore, the amount of underground gold yet to be mined / discovered, is based on estimates and is a moving target, depending on the advent of new technologies including big data, AI, and smart mining (plus rumors on Elon Musk eyeing asteroid gold mining). Hence, gold’s remaining minable amount cannot be determined, at least not with a 100% accuracy.

On the other hand, macro factors aside, Bitcoin does make a good candidate for the S2F model, since its S2F (red line in chart below) behaves in a predetermined and controlled manner, based on its source code.

The other unique and important characteristic of Bitcoin vs gold is its halving events, illustrated as purple spots in the chart below.

Bitcoin: S2F vs Price

Source: LookIntoBitcoin.com

Notice Bitcoin’s price action post-halving events.

"All models are wrong, but some are useful"

- George Box

Some have criticized Bitcoin's S2F valuation model, and obviously, no model can predict the future with 100% accuracy. However, Bitcoin's S2F has been historically close in forecasting its future prices, give or take a few weeks.

Source: Pantera

At the time of writing, Bitcoin has already surpassed Pantera's 15 Nov 2020 price target of $27,057, exactly 6 weeks late on 27 Dec 2020.

The Gift of Bitcoin

"As a thought experiment, imagine there was a base metal as scarce as gold .. and one special, magical property: can be transported over a communications channel"

- Satoshi Nakamoto

Invented as a modern form of "digital gold", Bitcoin seemed like some sort of libertarian sci-fi form of a financial asset. Truly digitally native and completely off the traditional rails of banking & finance, Bitcoin's future was set when it was launched in 2009. Copies of its code run all over the world, working together to process transactions every second of every day since it was launched. Running over twelve years in, it has been virtually impossible to hack. It is going to be very, very difficult to replace Bitcoin.

There are approximately 100 million people using Bitcoin now, locking in over $500 billion in value. Surprisingly successful during a pandemic, Bitcoin is quickly becoming a competitor to gold in some institutional portfolios, legitimizing its status as a store of value. Some predict that even central banks will start adopting Bitcoin in the next decade or so. Coupled with the increasing shortage of bitcoins, its investment thesis is stronger than ever.

The true gift of Bitcoin is its predetermined monetary policy – 21 million bitcoins and not a single satoshi more.

Merry Christmas and Happy New Year, Satoshi...

Disclaimer: Nothing written in this post is intended to serve as financial advice. Do your own research.

Let’s get in touch. Follow @iamkenchia for real-time musings, and connect with me on LinkedIn.