Bitcoin is the greatest behavioral economics-based network of all time - Raoul Pal

One of the most common questions I receive is on valuing Bitcoin - what are its return drivers? Since there are no cash flows, what are some of its key metrics?

It is hard to imagine that institutions would allocate millions and billions of their cash reserves to a completely digital and highly volatile asset. Yet that has happened.

A bitcoiner would tell you that Bitcoin is “the hardest form of money", "it is Gold 2.0", "censorship-resistant and completely decentralized store of value", etc.

If that completely lost you, you are not alone.

At the end of the day, institutional money will need institutional narratives.

Metcalfe's Law was introduced circa 1980s originally to explain the effects of the number of users to the value of a telecommunications network ⏤ referred loosely as "the network effect".

The concept is simple: the more the network grows, the more valuable the network becomes to the community.

Facebook demonstrated Metcalfe's Law when it filed for IPO in 2012 ⏤ at a staggering valuation of $100 billion. A quick Google search into the past reveals countless skeptics criticizing its insane valuation at the time.

But that was then. Today Facebook's valuation is over $700 billion.

Facebook proved that it was possible for a new social metric to emerge valuable ⏤ perhaps even more valuable than plain old company cash flows.

It was a new valuation metric. One based on behavioral incentive systems.

Any network that managed to climb Metcalfe’s Law made the shareholders extremely rich: Google, PayPal, LinkedIn, Amazon, Reddit, Twitter, Uber, AirBnB. Etsy, etc.

Does this apply to Bitcoin?

Bitcoin's Social Network

Source: Pantera Capital

There is indeed a strong relationship between the number of Bitcoin users and its price ⏤ the more people using Bitcoin, the higher its price. Pretty straightforward.

There are 7.8 billion people in the world, roughly 3.5 billion (half the world) owning smartphones. A smartphone is all you need to have access to cryptocurrencies.

Currently, there are approximately 100 million people using Bitcoin ⏤ representing only ~1% of the global population, and under 3% of all smartphone users. It is not impossible to imagine that this number will reach at least 1 billion people within the next decade.

Today, 2.8 billion people log on to Facebook at least once a month.

If there were a billion people buying something that is truly scarce and fixed in quantity, its price would go up. By a lot.

But Facebook ≠ Bitcoin

However, the comparison becomes more nuanced here.

For Facebook, its users and owners are separate parties, with separate interests:

Users are the product; and

Owners (shareholders) benefit from the product (users)

Whereas for Bitcoin, the network users and owners are one. Their interests are aligned.

Its growing amount of owners thus make the network more valuable, jointly prospering in a distributed system.

So where is Bitcoin in its social adoption cycle?

The Adoption Curve

Source: Real Vision

The short answer ⏤ early. If you bought bitcoin in the last couple of months, you are early. If you bought bitcoin today, you are early. If you buy bitcoin next month, you are still early.

If you are reading this somewhat close to the time it was written, you are by definition in the “Innovators” category.

It doesn't take too many billionaires and companies buying to move the price of Bitcoin ⏤ Raoul Pal, CEO of Real Vision

Plus, with big institutions coming into the space and buying (much) more bitcoin than the average person, it would require less “users” than projected to drive exponential moves.

Bitcoin vs Traditional Dollars

"I believe Bitcoin is one hell of an invention. To have invented a new type of money via a system that is programmed into a computer and that has worked for around 10 years and is rapidly gaining popularity as both a type of money and a storehold of wealth is an amazing accomplishment" ⏤ Ray Dalio

(Ray Dalio, by the way, has been a long time Bitcoin skeptic and has only recently turned positive in his latest piece published just over a week ago on Bridgewater’s Research & Insights library).

Bitcoin's meteoric rise in the past few years is not by chance. It has the best narrative, especially in today's inflationary macro environment. Quite literally whenever someone joins the network and buys bitcoin, it goes up in value due to its restricted supply ⏤ its supply dynamics make it so compelling to our basic behavioral instincts.

“A billion here, a billion there, and pretty soon you’re talking real money.” — Attributed to U.S. Senator Everett McKinley Dirksen

As governments print more quantities of paper money, it takes more pieces of paper money to buy things with fixed quantities ⏤ real estate, gold, Bitcoin, etc ⏤ inflating prices of those things along the way.

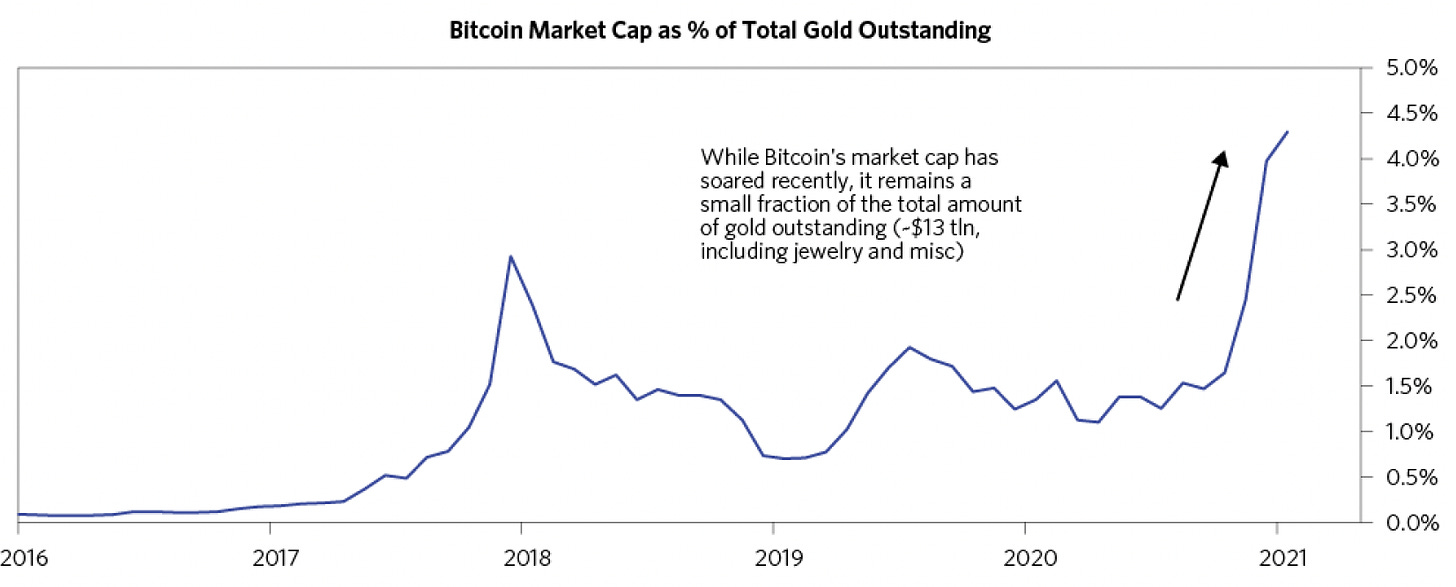

Bitcoin remains as a long-term investment with extreme volatility in the short-term, only because of how early it still is in its adoption cycle. Bitcoin is still under 10% of gold's market cap. Being early comes with the price of volatility.

If early-stage VC investments could be marked-to-market, those investments would be equally (or perhaps more) volatile compared to Bitcoin today. Every single start-up would look like it is going bust several times.

Listen to everyone, read everything; believe absolutely nothing unless you can prove it in your own right! ⏤ Milton William Cooper

Build your own conviction and thesis. Question that thesis. Reflect that in your holdings. Then don't look at them for a few years.

If January was any indication of how the rest of 2021 will be, it is going to be an extremely exciting year ahead.

Further reading

Peterson, T. (2020). Metcalfe's Law as a Model for Bitcoin's Value

Genius Works: Metcalfe’s Law explains how the value of networks grows exponentially

Deribit Insights (Hasu): Why I have changed my mind on tokens

Disclaimer: Nothing written in this post is intended to serve as financial advice. Do your own research.

Let’s get in touch. Follow @iamkenchia for real-time musings, and connect with me on LinkedIn.