GMX v2: Should Liquidity Providers Allocate to GM or GLP?

GLP has been a staple holding in institutional portfolios as a source of juicy high yields. GMX recently launched its v2, introducing significant changes including GM replacing GLP as the token for liquidity providers (LPs).

How will GMX v2 affect LP yields?

Quick Recap

GLP is the LP token of GMX v1, earning 70% of fees on all GMX pools (total >$200M to date). These fees translate into yield for GLP holders, which fluctuates on a weekly basis.

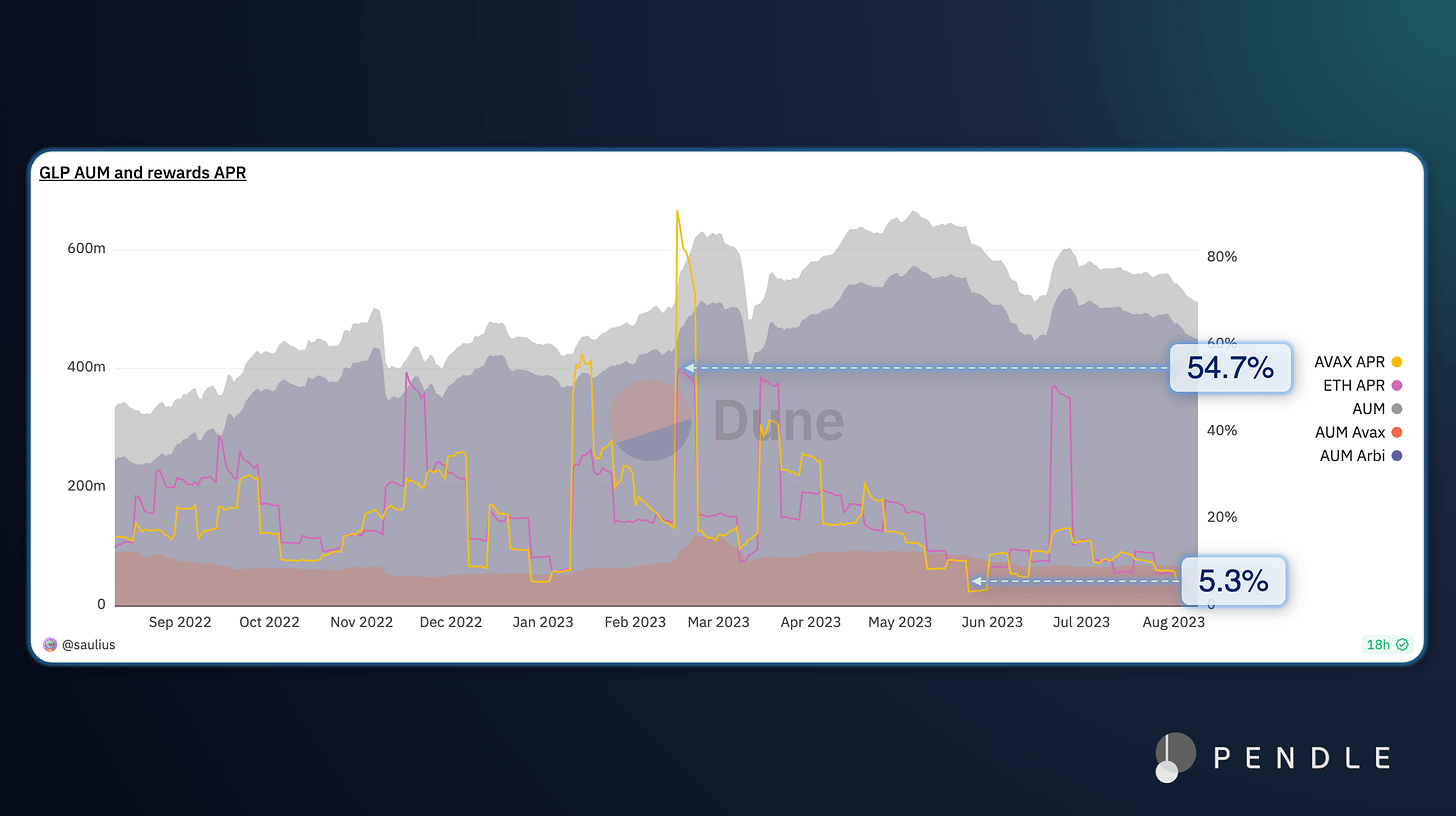

In past 12 months, GLP yields traded in a wide range from 5% – 55% APR.

What happens to GLP yields going forward?

if v2 fails to take off, flows come back to v1 -> GLP APR ⬆️

if v2 takes off, it cannibalizes liquidity from v1 -> GLP APR ⬇️

Also, will GM have higher/lower yields vs GLP? Let's dive into the v2 changes most relevant to LPs.

GMX Overview

v1 issues: Traders love zero price impact trading. However this opens up the potential for price manipulation at the expense of LPs (ie AVAX/USD exploit Sep 2022)

v2 goals:

1. ⬇️ LP Risks (new isolated pools)

2. ⬆️ Trading Volumes and Liquidity (via lower fees)

Let's explore the two goals in v2 above:

1a. ⬇️ LP Risks

v1: LPs exposed to all assets (more risk).

v2: LPs exposed to isolated pools (less risk) – LPs determine which specific pools (individual trading pairs ie ETH/USD or BTC/USD pools) to take risks on.

1b. ⬇️ LP Risks = ⬇️ Fees Earned by LPs

Along with less risks, v2 LPs also earn less in fees (amount is instead distributed to the GMX Treasury)

GLP: LPs earn 70% of fees on *all GMX pools* 💰

GM: LPs earn 63% in *a single GMX pool* 💸

2. ⬆️ Trading Volumes and Liquidity (lower fees)

Additionally, v2 fees are also lowered across the board to incentivize more trading.

Assuming no change in volumes + liquidity, there will be less fees earned for LPs.

Only time will tell.

LP yields are critical to attract liquidity.

GMX's past success has been attributed to its GLP model with historically high yields to incentivize LPs (>20% APR).

In order for GMX v2 (and GM LPs) to succeed, the fine balance between fees, volumes and LP yields is vital.

Yield market views

All else equal, GM yields are expected to be lower (currently 10%) vs GLP's historical APRs, unless counterbalanced with a increase in trading volumes

Currently liquidity is expected to be fragmented across v1 and v2 pools until a clear winner dominates

What is the institutional play?

Institutional investors seek sustainable and predictable yields.

As the largest swaps market for fixed and floating GLP yields in DeFi, Pendle is often used to lock in fixed APYs when GLP yields are high, or to trade the direction of yields.

PT GLP (fixed GLP yields) is currently trading @ 11.3% APY.

With underlying APY @ 5.73%, the writing is on the wall.

In past weeks, PT longs have dominated the GLP yield market to fix & secure double digit APYs while it lasts.

Of course, there are always edge cases:

Perhaps v2 fails to attract more volumes and liquidity, flows then return to v1, pumping GLP yields back to >20% APR

Perhaps overall mkt volatility picks up, both GLP and GM yields then pump simultaneously

View original Twitter thread:

Pendle: https://app.pendle.finance/

Pendle is the leading swaps markets and yield trading protocol in DeFi. Pendle’s adoption as a DeFi primitive has been growing across protocols and institutions to generate more yield, lock-in fixed term yields and directionally trade yield on yield-generating LP assets.

Disclaimer: Nothing written in this post is intended to serve as financial advice. All content in this post serves merely for informational purposes.