This week's issue of Bridging Bitcoin can be read in 5 mins and 51 seconds.

Have feedback on Bridging Bitcoin, or have any topic requests? Just hit “Reply” and send it our way to ken.chia@substack.com.

For those who are not yet subscribed, I write on Bitcoin and cryptocurrencies from a macro perspective. If that interests you, subscribe to get a weekly issue delivered directly to your inbox:

Happy New Year, everyone. What a start to the year it has been.

In just the first week of 2021 alone, the following took place:

4 Jan 2021: Bitcoin made front page on Financial Times on the first Monday of 2021

5 Jan 2021: J.P. Morgan releases a long-term price target for Bitcoin of $146,000

7 Jan 2021: The CFA Institute published a report titled Cryptoassets: The Guide to Bitcoin, Blockchain, and Cryptocurrency for Investment Professionals

7 Jan 2021: Bloomberg released its Crypto Outlook report for Jan 2021 titled: Bitcoin May Be Better Than Gold

8 Jan 2021: Bitcoin hits its new all time high of $41,941

What a start indeed.

The CFA Institute has issued publications on cryptocurrencies before in the past, but none as comprehensive as this one (read: 64 pages long), specifically analyzing Bitcoin in a portfolio setting.

The Bloomberg Crypto Outlook is monthly publication running since 2018.

The timing of these two publications could not have been better. With how much institutions have allocated into Bitcoin in 2020, both reports by the CFA Institute and Bloomberg have been published at a point of inflection at the start of 2021, adding credence to Bitcoin's role in modern institutional portfolio management.

The 60/40 No Longer Applies

Today’s dominant portfolio consists of stocks and bonds. The familiar 60/40 portfolio — a staple mix of equities and bonds — has been an industry standard for decades, producing an average annual return of 8.1% p.a. since 1926.

However, a quick Google search on the 60/40 portfolio today yields countless hits criticizing the traditional portfolio allocation strategy, some claiming that it is at risk of being obsolete.

The biggest concern among money managers in today's macro environment is this: unprecedented monetary inflation, as a direct result from the seemingly unlimited and nowhere-close-to-ending printing of dollars.

In essence, in order to support the economy and financial markets during the years of a global pandemic, central bankers have clearly stated their intent to diminish the dollar's value via 2% each year, in perpetuity.

The chart below illustrates the M2 Money Supply spiking almost vertically in 2020.

Source: Federal Reserve Bank of St. Louis

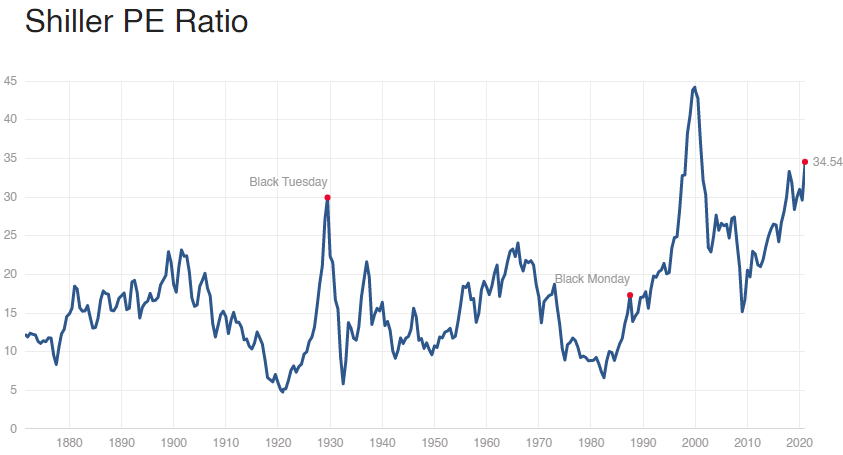

In such an environment, rates have been lower than at any time in human history, and stocks are close to its highest ever valuation multiples.

Source: Federal Reserve Bank of St. Louis

Source: multpl.com

The narrative from Wall Street professionals are also in unison:

“It is hard to see where your equity return comes from... low bond yields will not help offset a poor performance from the share market. It’s just the math.” – Vincent Deluard, global macro strategist at StoneX Group

Analysts at Bernstein wrote that valuations imply returns of about 5 per cent per annum on the S&P 500 for the next decade and that “today's unprecedented low level of yields means that future returns are likely to be low and interest-rate risk is higher than ever before”.

“...the standard 60/40 portfolio is not very well suited for today’s financial market environment” – David Kelly, chief global strategist at JPMorgan Funds

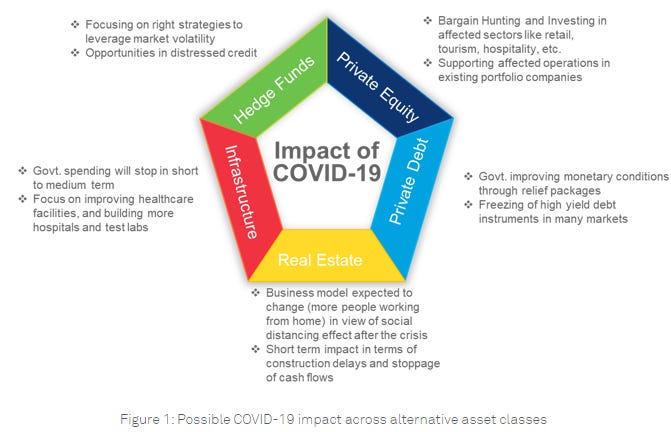

The incumbent solution to i) reduce correlations to conventional markets, ii) diversify portfolios and iii) to hedge against inflation, is to rotate into alternative investments (real estate, infrastructure, private equity, luxury art, etc) – assets that have historically demonstrated the potential to outperform stocks and bonds over the long-term.

However, return drivers of these assets have become even more nuanced with the advent of the COVID-19 pandemic:

Source: Wipro

Today, we have one other solution: Bitcoin.

The Role of Bitcoin in Institutional Portfolios

Disclaimer: The following are my own interpretations of the publications issued by the CFA Institute and Bloomberg. Any discrepancies should be construed as my own personal views and not of the respective authors'.

Unique Risk-Return Asymmetry

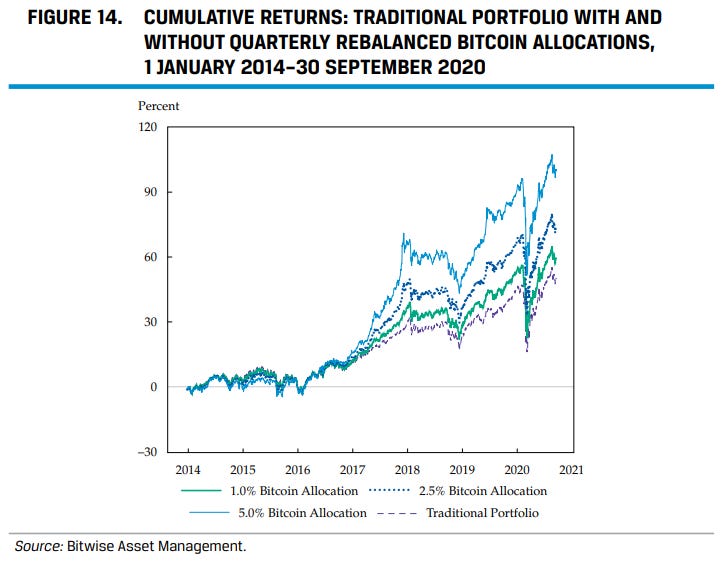

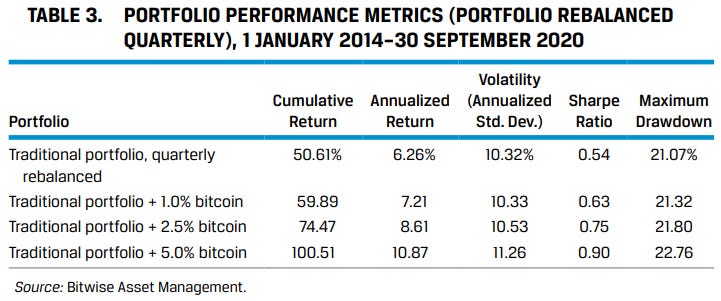

Small allocation, significant impact. In the case of quarterly rebalanced portfolios (maintaining a fixed percentage allocation to Bitcoin over time), even a small allocation to Bitcoin results in significant positive impacts on long-term portfolio returns.

Better risk-adjusted returns. The table above illustrates that small allocations (between 1% to 5% of total portfolio assets) to Bitcoin results in both higher returns and better Sharpe ratios (indicating better returns per unit of risk).

Low Correlation to Conventional Assets

Bitcoin exhibits low long-term correlation to traditional asset classes. Additionally, this low correlation will likely persist due to significantly different underlying core drivers between bitcoin's value versus that of traditional stocks and bonds — see table below.

Bitcoin vs Stocks

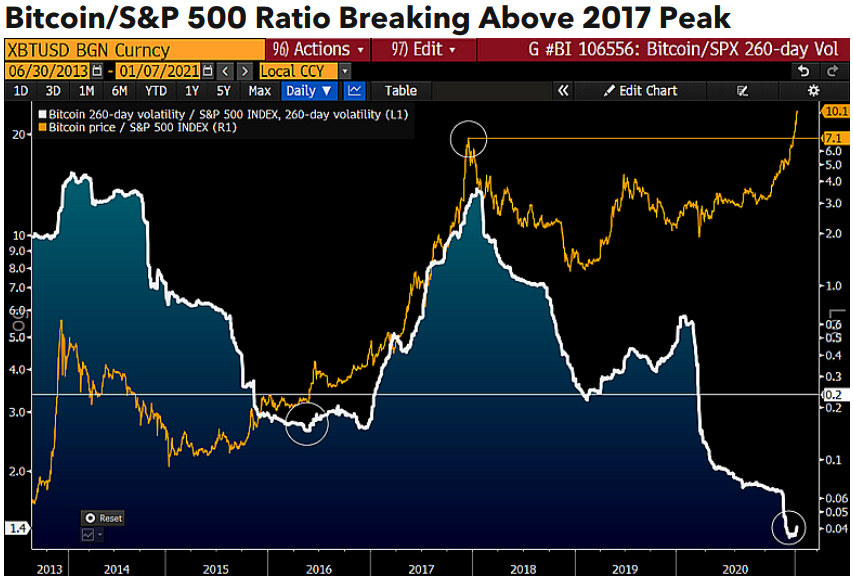

Potential for higher risk-adjusted returns over the long term. With seven years of historical data (Bitcoin started trading circa 2010, but only really took off in 2013), a clear trend emerges:

Bitcoin's volatility vs stocks is trending lower (white line); while

Bitcoin's price multiple vs stocks is trending higher (gold line)

Worth highlighting: towards the end of 2020, Bitcoin's annual volatility almost reached the same level as the world's most significant stock index at a 1.4x multiple (white line), as the Bitcoin market continues to mature and develop.

Bitcoin vs Gold

We view Bitcoin and gold as portfolio companions - Bloomberg Crypto Outlook, Jan 2021

Bitcoin on path to rival gold in 2024 on volatility. While Bitcoin is currently still too volatile to be an immediate store of value, with a rising market cap and more mature players entering the market over time, Bitcoin's volatility has been trending lower towards gold's (thick white line, chart above). By its next halving in 2024, Bitcoin's volatility may match gold's.

Flows data indicate the market's vote favoring Bitcoin vs gold. Towards the end of 2020, a divergence occured: capital has been flowing out from gold and into Bitcoin (white vs pink lines, chart above). Grayscale Bitcoin Trust's assets under management (AUM), the leading indicator of institutional Bitcoin interest, grew exponentially in 2020. Today, the Grayscale Bitcoin Trust has over $21bn in AUM, representing roughly 3% of all bitcoins in circulation.

Market Reflexivity

As these trends continue to emerge and mature, markets tend to be reflexive. Over the past decade, as industry players continue to invest sweat equity and capital into blockchain technologies, Bitcoin's initial promise extends far beyond a simple alternative form of digital payment. With its decade-long track record now established, Bitcoin begins to emerge as a secure and promising store of value for institutions — a digital and better alternative to gold.

Feedback loops form — this wave of institutional adoption has only just begun in a market environment that is highly reflexive. The crypto industry continues to draw tech innovators, Wall Street veterans, as well as investors' capital, growing with more significance in each cycle.

Source: Messari - A Bright Orange 2021

With publications from reputable industry leaders such as the CFA Institute and Bloomberg, market trends and portfolio analyses are brought to the attention of traditional money managers, while adding credence to Bitcoin's role in institutional portfolios.

As stronger trends emerge, investors become more willing to invest in larger amounts, which then provides incentives to governments to allow this new technology to grow alongside their versions of digital dollars.

Central banks may adopt Bitcoin in their treasury reserves in coming years.

Reignited during the first year of a global pandemic, Bitcoin emerges as another “new normal” in financial markets: a digital asset with seemingly no intrinsic value becomes increasingly safe to hold the more its price rises. A digital asset that derives value purely from its predetermined monetary policy.

Money managers and investors are looking for alternatives to the 60/40. Financial advisors are upgrading their toolkits. Unless these trends reverse significantly, Bitcoin is likely to continue appreciating, serving its role in institutional portfolios as an instrument with low correlations to conventional assets and an asymmetric risk-return profile.

One thing is for certain: The emergence of a new asset class and financial ecosystem is a rare event, and the potential for cryptoasset-powered blockchains to move the world forward is exciting — Matt Hougan, David Lawant

Primary resources:

Bloomberg Crypto Outlook Jan 2021 - Bitcoin May Be Better Than Gold

Bloomberg Crypto Outlook Dec 2020 - Bitcoin Joining 60/40 Mix

Disclaimer: Nothing written in this post is intended to serve as financial advice. Do your own research.

Let’s get in touch. Follow @iamkenchia for real-time musings, and connect with me on LinkedIn.