The largest asset manager in the world invests in Bitcoin - Bloomberg

The richest man in the world invests in Bitcoin - CNBC

Banks take Bitcoin seriously and provide research coverage on Bitcoin - Morgan Stanley; Financial News

If three years ago you told me that these would make headlines in 2021, I would have told you that you were delusional. That you were part of some crypto maximalist Internet cult.

But they have happened in just the first two months of 2021.

“Through the insatiable buy-side pressure from exchange-traded fund (ETF) issuers, closed-end funds and large public corporations adding bitcoin to their positions, demand is massively outstripping supply,” ⏤ John Willock, chief executive at digital asset exchange Blocktane

How did we get here? It almost feels like Bitcoin has become an overnight success.

The Shift Towards Ownership

In the previous issue, I touched briefly on the concept of ownership in networks.

Online platforms including Facebook, Twitter and Airbnb all source their content and products from individual users, instead of agencies or corporations. Without users there is no content, no product, no network effects, etc.

Today, the existing business model of the world's largest online platforms concentrate the creation of value and economic interests among corporations and shareholders, instead of their users ⏤ the most valuable contributors for their success.

We are seeing this shift towards ownership happening today:

Ownership [is a] more cooperative economic model... [it] helps ensure better alignment with users over time, resulting in platforms that can be larger, more resilient, and more innovative. This is the Ownership Economy, and beyond being a positive social endeavor, the platforms building it are able to leverage the strongest form of market incentives to grow network effects ⏤ Jesse Walden, former a16z, Founder of Variant Fund

Bitcoin is the first user-owned and user-operated network at scale in history.

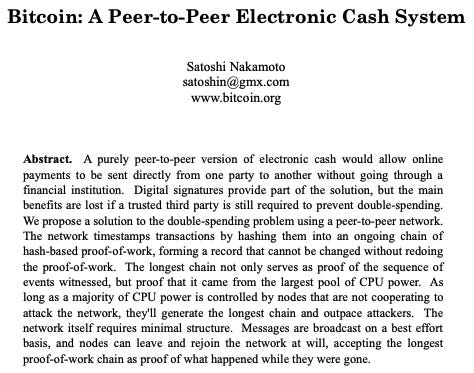

Source: Bitcoin: A Peer-to-Peer Electronic Cash System aka the Bitcoin whitepaper

Ownership is at the core of the success of Bitcoin ⏤ in the Bitcoin whitepaper, the term "user" was only mentioned twice while "owner" / "ownership" was mentioned 19 times.

Instead of the typical societal barriers to economic success such as having to work in specific industries, live in certain countries or attend elite schools, anyone with an Internet connection could participate by joining and securing ("mining") the network. In return, they would earn their newly minted Bitcoin, an ownership stake in the network itself.

People were literally paid to join the network, in return for their computational contributions in securing the Bitcoin blockchain. When Bitcoin was first mined into circulation, outsiders thought it was worthless. But natural behavioral incentives brought the network together, aggregating its owners' collective grit to convince outsiders to join their purpose.

At the time, no company marketed it. No one knew who the pseudonymous Satoshi Nakamoto really was or if he was even alive.

So, on 18 Feb 2013, this was made for a Reddit ad on r/bitcoin. On Ms Paint.

Bitcoin participants were incentivized to evangelize the Internet with their magic Internet money, not allowing their limited artistic skills to dissuade them otherwise.

They were were able to earn and grow the value of their collective contributions to the Bitcoin network. A network that only grows bigger, stronger, more secure and better over time.

They were able to be owners of a network, instead of just users.

Gradually, Then Suddenly

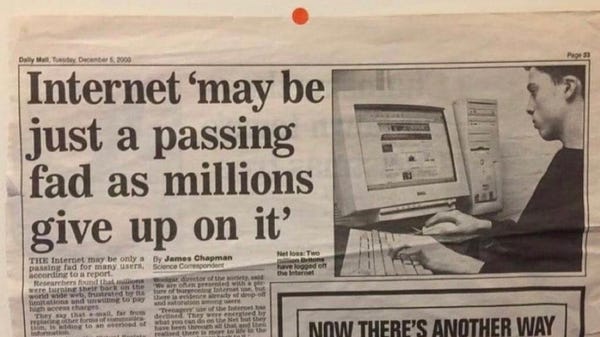

In the early days of the Internet (think TCP/IP, dial-up modems), the user experience was clunky, slow and unintuitive. There was neither much content nor utility ⏤ yet.

It was very difficult to foresee its future as one of humankind's most transformative and fast-growing technologies.

The growth of the Internet will slow drastically, as the flaw in "Metcalfe's law"--which states that the number of potential connections in a network is proportional to the square of the number of participants--becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet's impact on the economy has been no greater than the fax machine's ⏤ Paul Krugman (1998), Economist

Source: The Internet Archive

Today, the Internet has allowed me to share my musings on magic Internet money with you and many others ⏤ instantly and for free. I don't know a single person who uses a fax machine now.

In Dec 1995, the only 0.4% of the world's population used the internet. Fast forward to 30 Dec 2020, 64% (over 5 billion people) of the world is online (source).

“When I took office, only high energy physicists had ever heard of what is called the World Wide Web... Now even my cat has it's own page.” ⏤ Bill Clinton

Bitcoin today is very similar to the early days of the Internet protocol suite, or more commonly known as TCP/IP. TCP/IP is the foundational layer of the Internet which allows packets of data to flow through the network reliably.

The Bitcoin protocol was built on the Internet as an additional information layer. But instead of just data, the Bitcoin protocol also allows value to flow through its unstoppable network reliably. This value is created out of the network owners' labor via mining. In turn, mining makes the network even more secure and reliable.

Metaphorically and quite literally speaking, money is nothing but a store of value, a product of someone's labor.

While the Internet provided access to distributed information globally, Bitcoin provided access to decentralized money to anyone with an Internet connection.

Bitcoin today is akin to the Internet in the late-90s (Netscape was invented in 1994). If the history of the Internet is any indication of Bitcoin's adoption path, it is very likely that we are at the very beginnings of widespread and mainstream Bitcoin adoption. Just think of how much the Internet has evolved and grown over the past 20 years.

Think 20 years ahead for Bitcoin.

TCP/IP serves the world as the data protocol suite of the Internet network.

Bitcoin will evolve as a value protocol suite for transferring sound and hard money across the Internet.

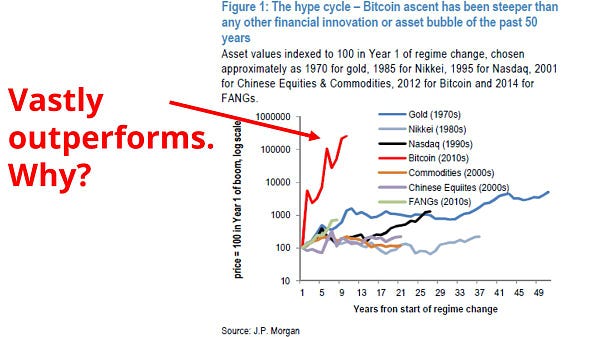

Bitcoin's Price As A Measure Of Adoption

“As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.” - Satoshi

Put loosely, Bitcoin is a viral marketing loop, where its users / owners are its primary marketers.

Bitcoin's price is the singular function that enables it to grow its user adoption, liquidity and security, which in turn then increases its future prices ⏤ a positive feedback loop. In some ways, Bitcoin's price is all that matters.

Its imbalanced demand-supply dynamic helps too.

“With only 18.6M Bitcoin in the world — and perhaps as much as 4M to 5M lost or not being offered for sale — there isn’t enough to satisfy the demand of +46M global millionaires, nor 1% to 5% of the estimated $4 Trillion of cash on corporate balance sheets in the U.S alone. Add in 1.8 billion millennials, mostly in countries with broken currencies or banking systems, and one can see that the supply of and demand for Bitcoin are NOT in balance.”

Although we are currently in a Bitcoin Supercycle, I believe that there are still ways to go towards its full potential.

Dips and corrections are lasting shorter and shorter. The recent intraday 20% dips last week were very quickly bought back up by healthy spot volumes (no leverage), with new hands frantically grabbing as much bitcoins on sale as they can. The Supercycle is kicking into gear.

“All truth passes through three stages: First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as self-evident.” — Arthur Schopenhauer

Even today, I still think that we are in the first stage.

-Ken Chia

Further reading:

https://variant.fund/the-ownership-economy-crypto-and-consumer-software

https://qz.com/1705375/a-complete-guide-to-the-evolution-of-the-internet/

Disclaimer: Nothing written in this post is intended to serve as financial advice. Do your own research.

Let’s get in touch. Follow @iamkenchia for real-time musings, and connect with me on LinkedIn.